Best Buy-to-Let Areas in the UK for High Returns (2025 Guide)

When it comes to rental yields and long-term property price growth, Manchester remains one of the best buy-to-let areas in the UK.

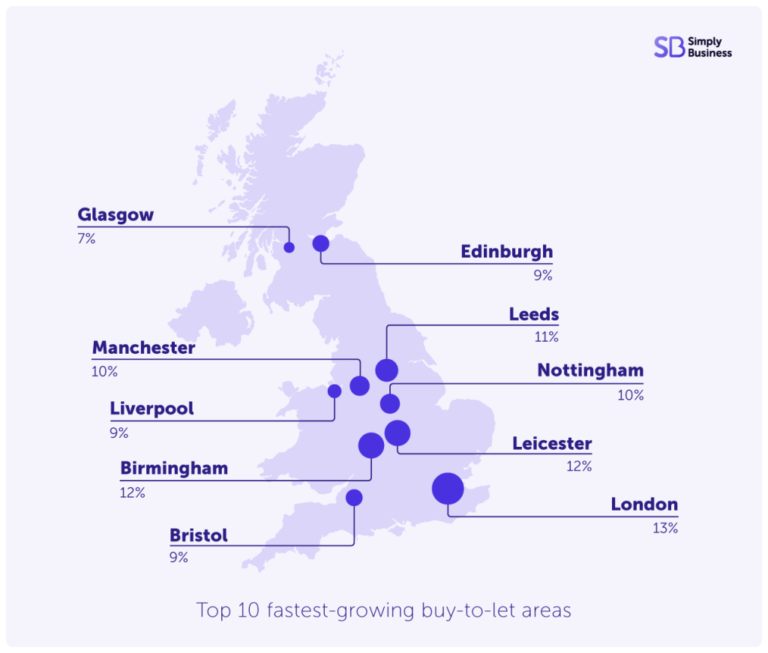

According to Aldermore’s Buy to Let City Tracker, the top-performing locations are ranked by returns, average rents, vacancy rates, and the proportion of residents renting.

Glasgow (up six places)

Coventry (new entry)

Wigan (up 21 places)

Bristol (down four places)

Despite its global appeal, London ranks only 32nd due to high average property prices reducing rental yields – a fall of 27 places compared with last year.

Beyond individual cities, investors are increasingly focused on regions.

Data from estate agency Hamptons reveals that in the year to April 2025, 39% of all buy-to-let purchases were in the Midlands or North England. This marks steady growth compared to 34% in 2022 and 24% in 2007.

In contrast, the South of England is becoming less attractive for landlords. Higher stamp duty and tax changes, combined with expensive property prices, have led to a decline: 43% of buy-to-let purchases were in the South in 2025, down from 53% in 2015.

Hamptons reports that the North East is the strongest region for buy-to-let investments. Over the last decade, every UK region has seen a decline in landlord purchases except the North East.

In 2025 so far, 28% of all buy-to-let purchases have been made in the North East.

The region offers the UK’s highest average gross yield at 9.3%, compared to the national average of 7.1%.

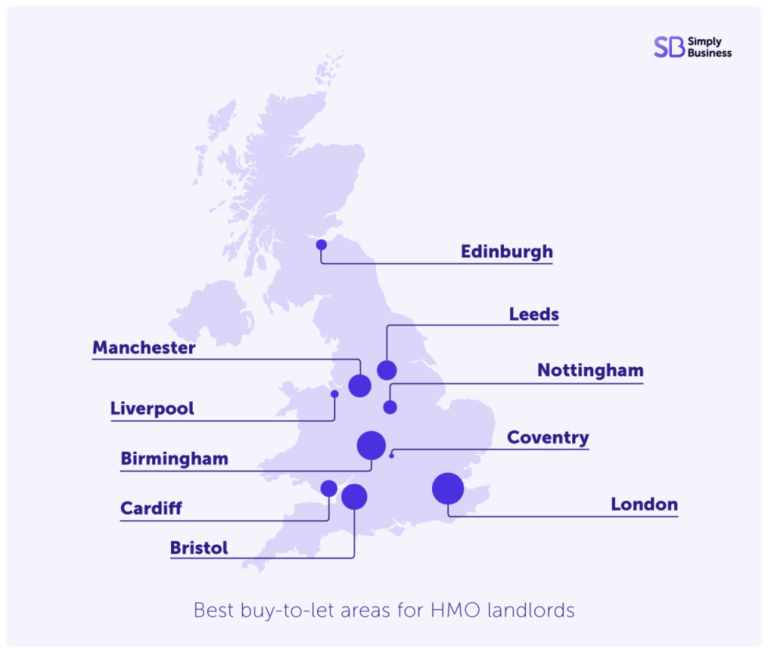

Houses in Multiple Occupation (HMOs) are larger rental properties let to three or more people from different households sharing common facilities.

For example, a house share with five young professionals would be classed as a “large HMO.”

To succeed with HMOs, landlords need to target markets with strong rental demand – typically university cities or urban centres with large numbers of young professionals.

It’s no surprise that the best HMO investment areas are those with both universities and strong job markets, making them highly attractive to students and graduates – and profitable for landlords.

While most UK landlords own a single property, many investors aim to build a portfolio over time.

A common strategy is to purchase one property, reinvest the rental returns, and grow steadily into a portfolio of rental properties. Some specialise in student housing investments, while others focus on specific cities or regions to maximise rental yields and long-term capital growth.

References to London Online on the website include all elements. Each entity in the London Online network is responsible locally for the management and ownership of its respective website(s). While London Online makes every effort to ensure that everything on the website is accurate and complete, we provide it for information only, so it is indicative rather than definitive. We thus make no explicit or implicit guarantee of its accuracy, and, as far as applicable laws allow, we neither accept responsibility for errors, inaccuracies or omissions, nor for loss that may result directly or indirectly from reliance on its content. Users of the website should not take or omit to take any action that relies on information on the website. London Online may correct or update the website without prior notice. In making the website available, London Online does not imply or establish any client, advisory, financial or professional relationship. Through the website, neither London Online nor any other person is providing advisory, consulting or other professional services.