Two-Year Mortgage Rates Drop Below 5% – Lowest Since 2022

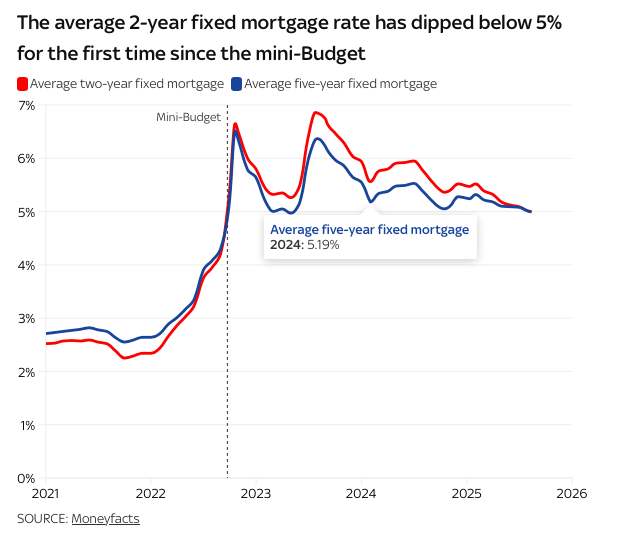

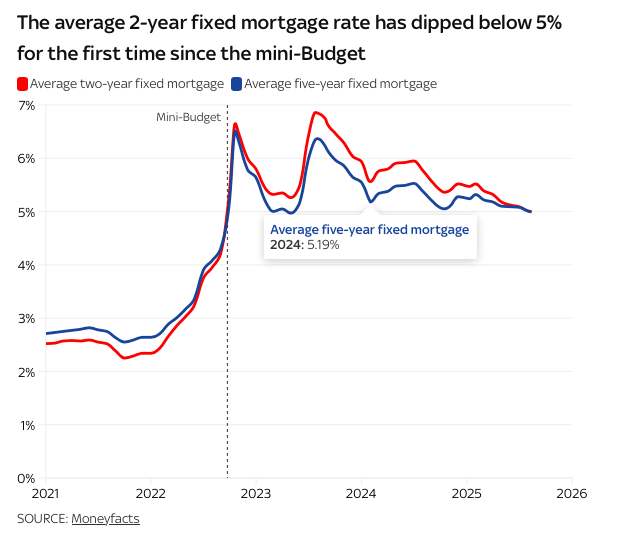

Good news for anyone keeping an eye on mortgages: the average two-year fixed rate has just dipped below 5% for the first time in almost three years. According to Moneyfacts, the typical deal now sits at 4.99%.

The last time rates were this low was back in September 2022, right before Liz Truss’s infamous “mini-budget.” That set of unfunded tax cuts and spending plans shook the markets, drove government borrowing costs up, and pushed mortgage rates to around 6%. The Bank of England even had to step in to prevent chaos in pension funds.

This drop follows the Bank of England’s decision to cut its base interest rate to 4% last week. Cheaper borrowing makes mortgages more affordable, and the move came as the Bank tried to support a slowing economy.

But don’t expect rates to fall too much further just yet. Inflation is still a worry—things like higher employer costs and weaker harvests are pushing up prices—so lenders aren’t rushing to offer bargain mortgage deals.

Moneyfacts says borrowing costs are still far higher than the super-low levels we saw before 2022. That said, the dip below 5% shows lenders are competing harder for customers, which could mean more choice and slightly better deals.

Looking ahead, markets expect another small cut to the Bank of England’s base rate before the end of 2025—possibly down to 3.75% in December. If that happens, we could see mortgage rates ease even further.

References to London Online on the website include all elements. Each entity in the London Online network is responsible locally for the management and ownership of its respective website(s). While London Online makes every effort to ensure that everything on the website is accurate and complete, we provide it for information only, so it is indicative rather than definitive. We thus make no explicit or implicit guarantee of its accuracy, and, as far as applicable laws allow, we neither accept responsibility for errors, inaccuracies or omissions, nor for loss that may result directly or indirectly from reliance on its content. Users of the website should not take or omit to take any action that relies on information on the website. London Online may correct or update the website without prior notice. In making the website available, London Online does not imply or establish any client, advisory, financial or professional relationship. Through the website, neither London Online nor any other person is providing advisory, consulting or other professional services.